Addictive buy now, pay later services designed to encourage overspending have sparked concerns as vulnerable young consumers find themselves in mounting debt.

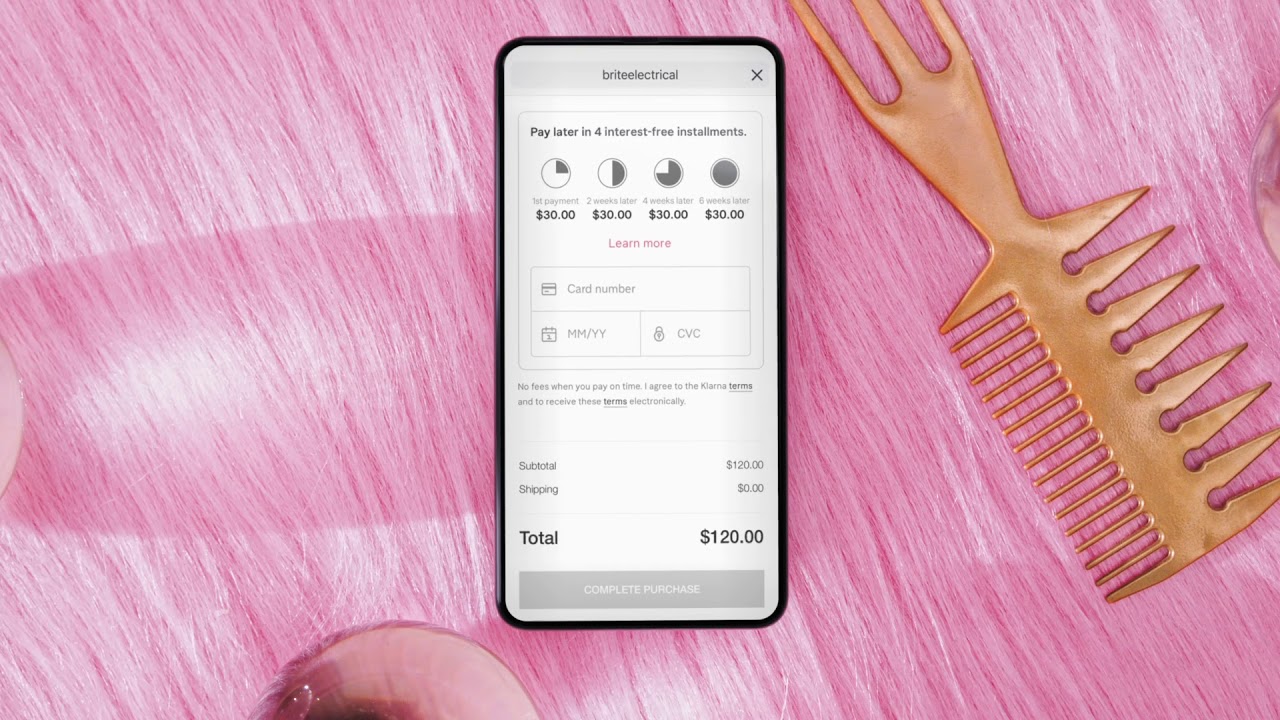

Since the start of lockdown, 23% of 18 to 24-year olds have turned to buy now, pay later services (BNPL) when shopping online, contributing to a shocking spike in bankruptcies within the age group. Designed to encourage overspending, these schemes have emerged as the ‘new normal’ for young, cash-strapped consumers, who are enticed by the option to get what they want, when they want – even if it isn’t financially viable.

With the shift from physical to online retail due to forced store closures worldwide, a significant influx of shoppers using BNPL schemes has arisen. Being able to return items without losing a dime is useful because it brings the changing room to the home, but it often leads to an impossible game of catch-up where young consumers end up spending far beyond their means, disregarding the negative implications that may follow.

Using my paypal loan to pay off klarna debt pic.twitter.com/iRMWHnNgcE

— Poppy (@poppybillingham) January 12, 2020

‘We don’t think retail checkouts should default to a buy now, pay later payment unless the consumer actively chooses that option,’ says Sue Anderson of debt charity, StepChange. ‘It gives people the chance to defer thinking about affordability at the point of sale and potentially encourages them to postpone that consideration until the point at which they actually have to pay.’

While it may sound like a dream-come-true, the issue lies in the fact that firms like Swedish start-up Klarna – popular for allowing shoppers to buy items without paying anything upfront – have not been forthcoming with information regarding the risks to consumers’ finances in their adverts.

In fact, these schemes have the potential to be very damaging, affecting credit scores if bills are left unpaid and passed onto debt collection agencies.

Although they’re not all-bad and can be hugely beneficial for savvy shoppers when used well, amidst reports of court hearings following naïve sign-ups, what’s clear is that consequences are relatively detrimental when BNPL isn’t approached with caution.

‘I was 18 at the time and I wasn’t aware that I had to manually set up a direct debit,’ says Poppy Billingham, whose been paying off £3,000 worth of BNPL debt for the last three years. ‘No one teaches you about borrowing money and getting in years worth of debt for a £45 Topshop dress’.

https://www.instagram.com/p/CBuql7Gnag2/