According to Textile Exchange’s latest report, the industry is producing more than ever before and shifts from conventional materials to lower-impact, sustainable alternatives have declined.

During the last few years, news of fashion’s pivot to more eco-friendly practices has repeatedly made headlines.

Whether genuinely impactful or an obvious bid to keep consumers interested, these updates on how brands are ‘doing better’ for the planet have seemingly trumped our consciousness of their wrongdoings.

Amid all the noise, revelations of greenwashing do little to sway our trend-chasing nature and, retailers continue to churn out product after product.

It should come as no surprise that according to the latest report from Textile Exchange, fashion is on track to miss its climate targets and exceed the 1.5 °C pathway laid out in the Paris Accord.

This is because while change is happening sector-wide (albeit at a snail’s pace), shifts to lower-impact, sustainable alternatives such as recycled polyester (rPET) or anything regeneratively cultivated have declined as international fibre production remains on the up.

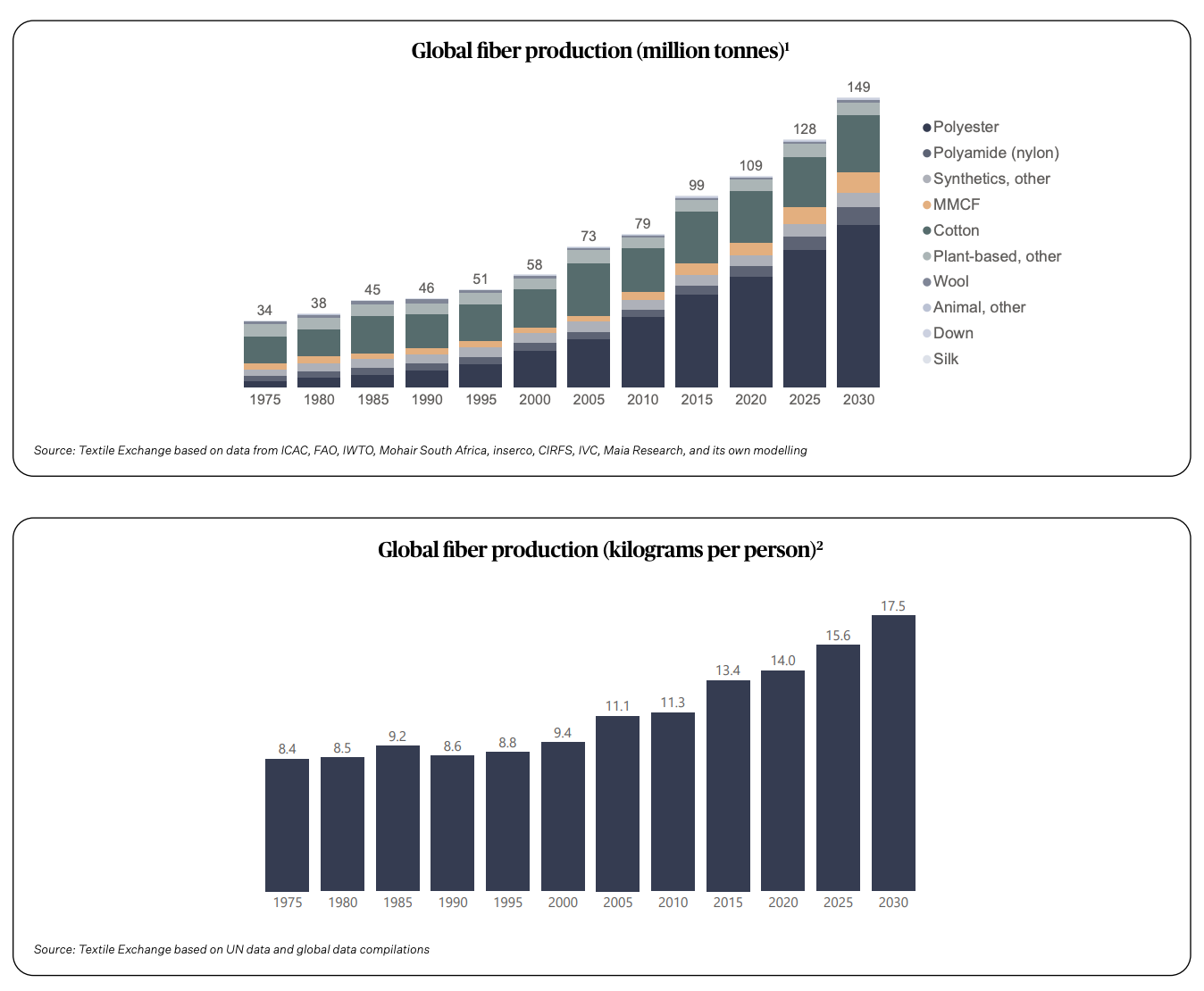

In fact – rather alarmingly – not only is it still increasing, but this exhaustive resource use is at the uppermost level it’s ever been, an all-time high of 113 millions tonnes, expected to keep growing to 149 million tonnes by 2030, which Textile Exchange says should act as a ‘major warning sign.’

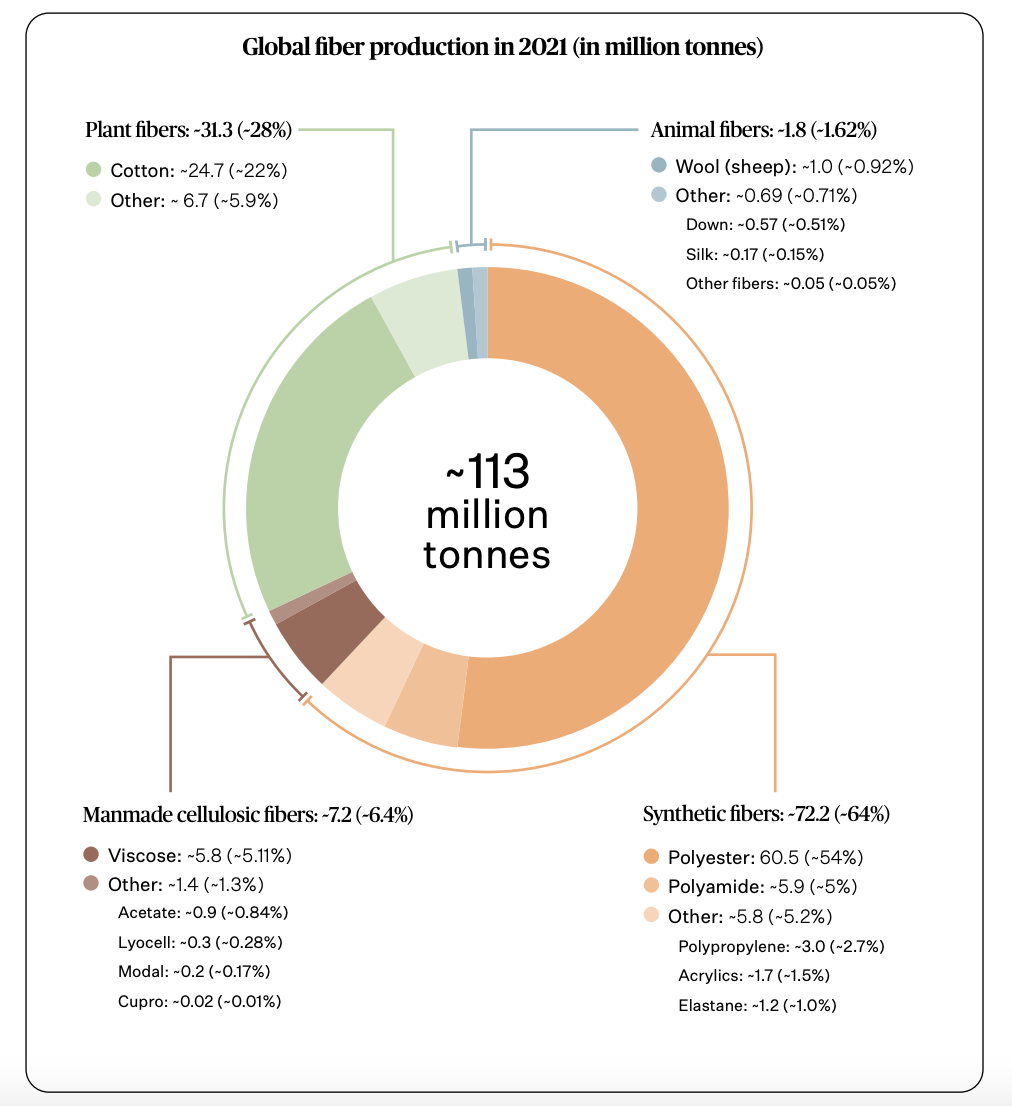

To put the situation into perspective, synthetic fibres reign as a low-cost option favoured in 64 per cent of production. This is followed not-so-closely by cotton and other plant fibres (28 per cent), man-made cellulosics (6.4 per cent), and animal fibres (1.62 per cent).

Within the synthetics category, polyester production has notably increased, from 57.7 million tonnes in 2020 to 60.5 million tonnes in 2021, despite the recently discovered threat to human and environmental health posed by microplastic shedding.