In London, a tech company called Walletmor is implanting customers’ hands with contactless payment microchips. Is this the future of financial convenience, or a step too far?

For the price of £230, which somewhat ironically is way beyond the contactless payment limit, London tech company Walletmor will implant your hand with a microchip that can be used to make contactless purchases.

If you’re down for a little augmentation and like the idea of becoming a walking wallet, all that’s required is a visit to a Walletmor specialist and install its online banking service on a phone or tablet.

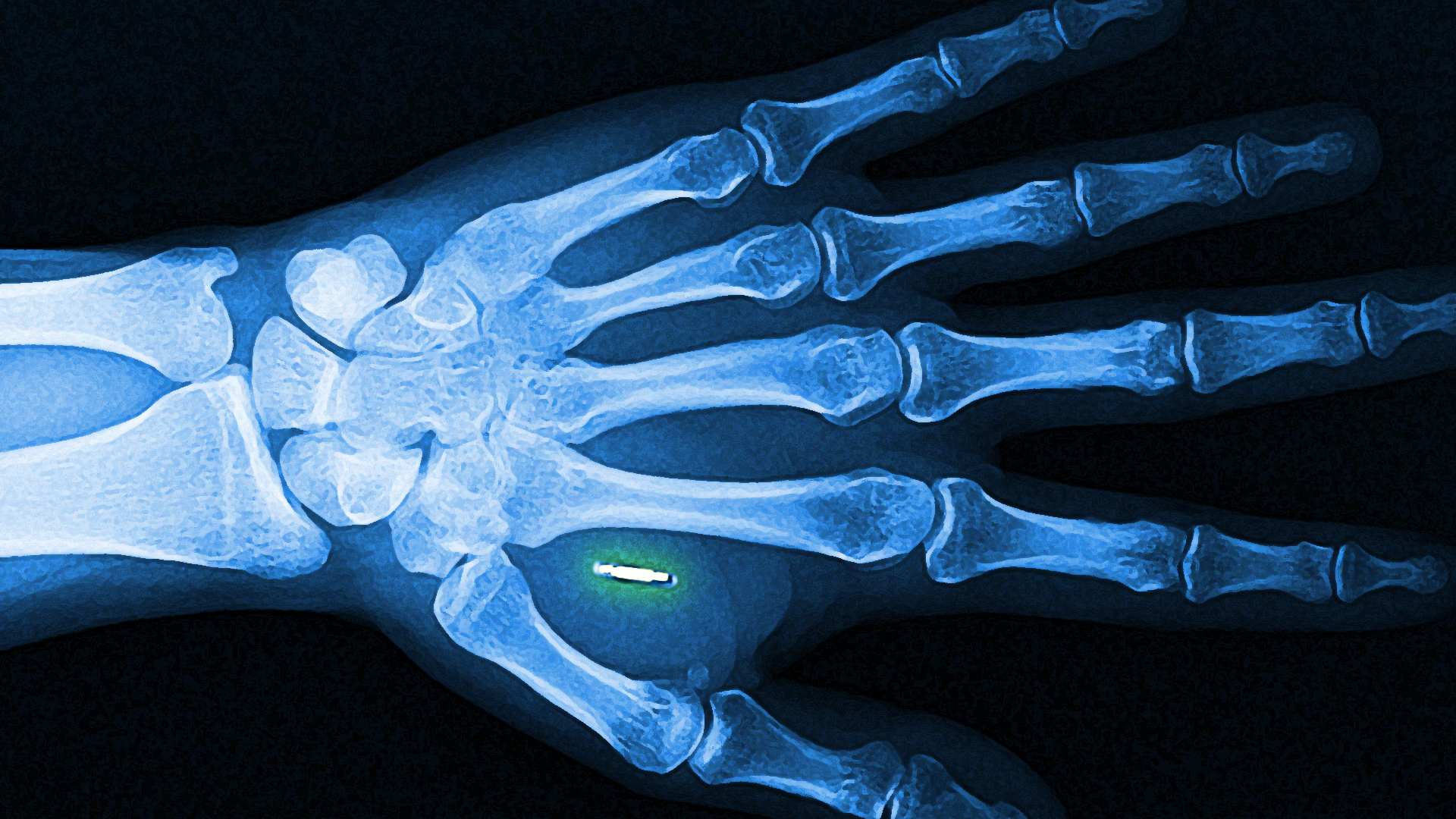

Once all the admin is completed, a surgeon (presumably qualified, and not on work experience) will make a skin incision around 7mm long and insert the chip into the palm – specifically, the chunky bit of flesh below the thumb called the ‘thenar,’ if you want to get technical.

The relatively painless procedure takes around four minutes to complete, as per the company site, and then you’re instantly free to begin confusing shop merchants and bus drivers across the nation.

The implants themselves are around the size of a grain of rice and are made from three elements; the NFC Chip, which acts as the hard drive where your account data is stored and encrypted, the NFC Antenna, that connects the chip to card machines, and the Biopolymer, responsible for protecting the other two components from any damages.