Ahead of hosting the world’s biggest climate summit, COP28, it looks like Dubai’s royals are attempting to clean up the UAE’s oil-rich image. But is setting up carbon credit schemes across Africa the way to go?

Sheikh Ahmed Dalmook Al Maktoum, a leading member of the royal family of Dubai, is on a mission to help major companies and national governments reduce their carbon footprint.

If you thought this meant halting new fossil fuel projects in the UAE and investing in global green energy projects, bless your sweet soul. Instead, the Sheikh has begun securing huge forest management deals for his carbon credit business, Blue Carbon.

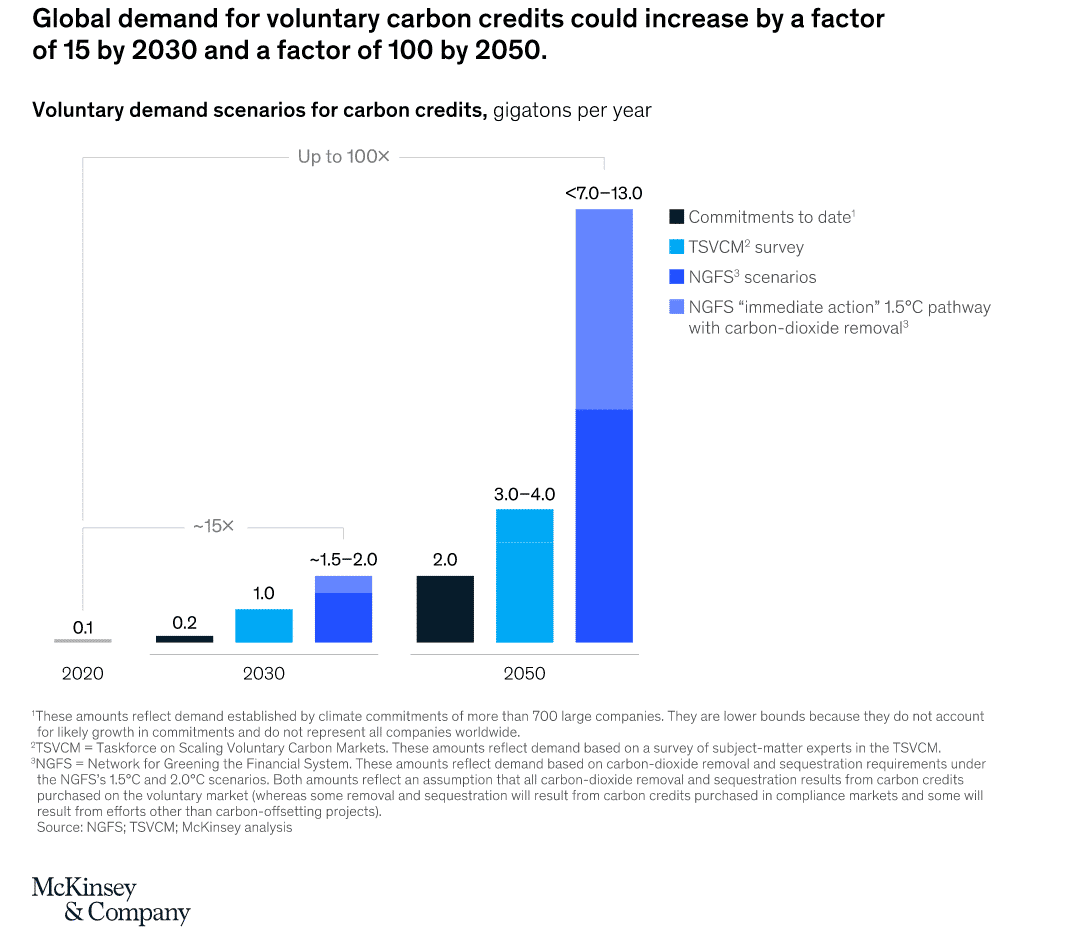

The Dubai-based company was launched last year and – like many other similar initiatives – allows major businesses and governments to purchase ‘carbon credits’ to help them ‘offset’ their annual emissions in order to get closer to reaching their sustainability targets.

It works like this: for every carbon credit purchased by a company or government, a sum of money is put towards projects that reduce or remove CO2 from the atmosphere. The buyer can then use these credits to subtract a determined amount of carbon from their annual emission reports and claim to be more eco-friendly.

But carbon credits are controversial, viewed by critics as ‘tradable instruments’ that enable high-emitting companies and governments to compensate for carbon emissions without actually having to reduce them.

In its latest deal, Blue Carbon has been granted permission to implement carbon credit projects and environmentally conscious initiatives across 7.5 million hectares of land in Zimbabwe.

The company has been awarded exclusive development rights to this vast area of land by Zimbabwe’s government and plans to use it for projects related to carbon offsetting, particularly in the areas of afforestation and agriculture.

Ahead of hosting the world’s biggest climate summit, COP28, this might seem like a great PR move. But anybody who has delved a little deeper into carbon credits will know that this strategy may not be a silver bullet.