Statistics in recent years have shown that China’s economy is declining and a meeting with more than a dozen CEOs from the US, reflects its efforts to mitigate the pressing issue.

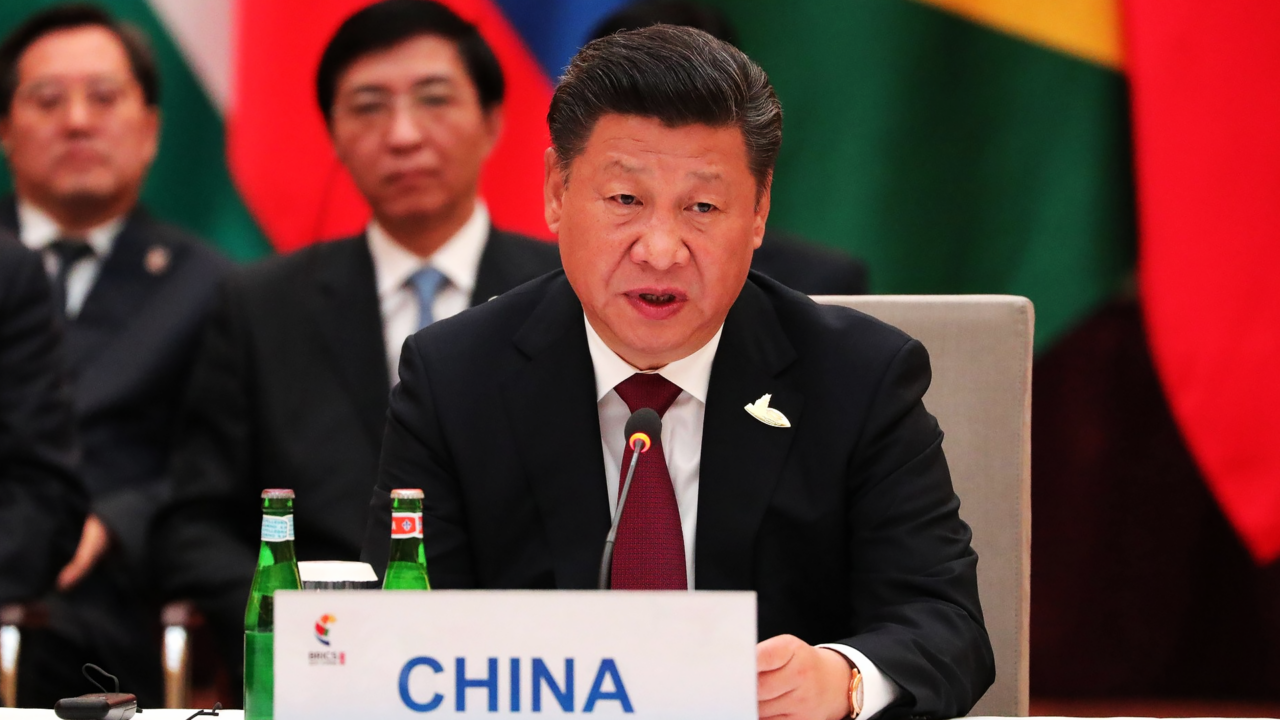

Last week, plenty of eyebrows were raised after it was revealed that China’s President Xi Jinping met with some of the top US CEOs. The meeting was set conveniently as over 100 CEOs globally were present in Beijing for the annual China Development Forum.

Tensions between the US and China have become a focal point of the geopolitical landscape, marked by strategic competition and disagreements on various fronts. The recent unexpected meeting adds a layer of intrigue to the already complex relationship between the two nations.

This strategic engagement underscores China’s interest in leveraging the expertise and resources of top US businesses to advance its economic goals and foster international cooperation.

Details of the meeting

On Wednesday, in an effort to attract foreign businesses to its economy – that remains one of the biggest globally – the President met with not just CEOs but academics too. Reports state that the gathering fell nothing short of candor as Xi explained the concerns with the Chinese economy and its decreasing foreign direct investments.

CEOs in attendance included Stephen Schwarzman, co-founder of Blackstone; Raj Subramaniam, President of FedEx; Mark Carney, Chairman of Bloomberg; Cristiano Amon, President of Qualcomm, and many more.

President Xi said when meeting with US business leaders & scholars: China & the US should help rather than hinder each other. As long as we see each other as partners, respect each other, coexist in peace & cooperate for win-win, China-US relations will get better. pic.twitter.com/UdOb4AD4Tp

— Spokesperson发言人办公室 (@MFA_China) March 28, 2024

The meeting aimed to address concerns about declining outside investment in China due to factors like slower growth, regulatory crackdowns, and questions about the country’s long-term prospects. Throughout, Xi maintained his optimism and a desire for a better future between the US and China.

Reports from the China Central Televisions showed the attendees attentively hearing out the Chinese leader as he addressed them.