Lord Michael Spencer, founder of ICAP, has suggested that British CEOs should be paid like professional footballers. It’s a claim that’s ignited a fiery debate.

If society accepts footballers raking in up to £20 million annually, why does it balk at CEOs of major companies, like BP or HSBC, earning comparable sums?

That’s what Lord Michael Spencer, founder of financial firm ICAP, has argued. It’s a controversial suggestion, and one that crumbles under scrutiny.

So let’s start with the numbers. Premier League footballers earn an average of £3.5 million annually according to Capology.com, with only a handful – 27 out of over 500 players – making upwards of £10 million. Players like Mohamed Salah or Erling Haaland may hit £20 million a year, but they’re exceptions, not the norm.

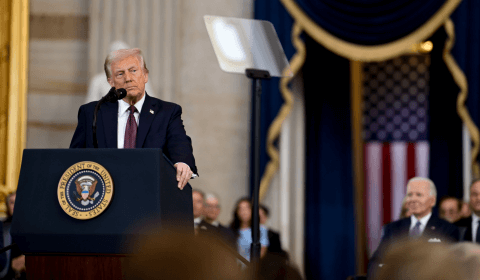

By contrast, CEOs of the UK’s FTSE 100 firms average £4.1 million a year. Their American counterparts dwarf this figure, with average earnings of $16 million (£13 million), a disparity that some argue is pushing British companies to set up shop in the United States.

According to the Financial Times, AstraZeneca’s Pascal Soriot, who is set to earn as much as £18.7m this financial year, is the best paid CEO on the FTSE 100. But it’s interesting to note that 36% of shareholders voted against his pay award.

Footballers, despite their astronomical earnings, operate in an industry where their pay is dictated by market forces – broadcasting rights, ticket sales, and sponsorship deals. And, as one social user argued, ‘a playing career is much shorter than [that of] a boardroom supremo.’

BREAKING: #ManCity have announced a third consecutive year of record-breaking revenues increasing to £715M, with sustained profitability at £73.8M, as confirmed in its Annual Report for the 2023/24 season.

— City Xtra (@City_Xtra) December 13, 2024

Their careers are notoriously short, often peaking in their late twenties or early thirties, and their earnings reflect not only their talent but the commercial success they fuel.

CEOs on the other hand, work in roles that often lack the direct visibility of a footballer’s performance on the pitch. For many, their high salaries seem untethered from tangible outcomes, especially when juxtaposed with the plight of workers in their companies earning less than a hundredth of their pay.

Lord Spencer’s analogy falters for another reason: football’s financial structure is designed with competitive limits. The Premier League enforces spending caps and financial fair play regulations to curb excesses and protect the integrity of the game.

CEOs face no such restrictions, leading to the sort of eye-watering bonuses that provoke public outrage, particularly in industries like banking or energy, where profits often coincide with consumer hardship.

And this disparity matters because of the societal contexts in which footballers and CEOs operate.

Footballers’ earnings may be extravagant, but they don’t carry the same moral weight. These athletes are ultimately entertainers whose paychecks are underwritten by the fans willingly buying tickets, merchandise, and subscriptions. CEOs, however, are custodians of companies that affect millions of lives through employment, product pricing, and ethical practices.

The argument that top executives deserve stratospheric pay because they helm complex, multinational corporations ignores the fundamental question of who actually benefits from these pay packets.

Defenders of high CEO pay argue that it attracts the best talent, boosts performance, and ultimately benefits shareholders.

But studies by organisations like the High Pay Centre suggest that excessive executive compensation doesn’t necessarily correlate with better company performance. Instead, it can breed resentment among employees, undermine morale, and exacerbate inequality.

Would a qualified executive really refuse to lead a FTSE 100 company unless they’re paid millions more? Or is it more likely that this narrative is pushed by those who stand to gain from perpetuating colossal executive pay?

Perhaps the better question isn’t whether CEOs should earn like footballers, but whether corporate Britain should adopt football’s approach to regulating pay.

Imagine if FTSE 100 companies had a salary cap tied to average worker earnings, or if bonuses were contingent on measurable long-term success. These kinds of measures could help restore public trust and ensure executive pay reflects performance, not privilege.

When FTSE 100 CEOs earn more than 100 times the average British worker, it’s clear something is broken. Instead of asking why executives don’t earn as much as footballers, perhaps we should be asking why they earn so much at all.