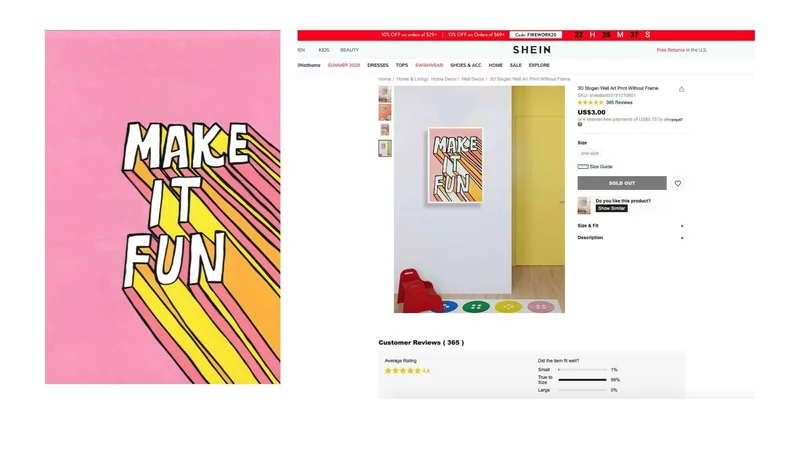

The ultra fast fashion retailer’s copyright usage, labour practices, and competitive behaviour have come under fire in recent months, threatening to hinder its plans for a takeover of the US market.

The linchpin of inexpensive, mass-produced goods with prices even eye-wateringly lower than PrettyLittleThing on Black Friday, SHEIN’s ubiquity – most notably on social media – has catapulted the Chinese conglomerate to cult status among trend-enthusiasts across the globe.

Giving ASOS a run for its money, it has contrived to conquer the world so rapidly that most of us didn’t even notice.

Now the biggest company of its kind (reported to have generated $100 billion in sales in 2022) SHEIN has completely redefined the fast fashion model right from under our noses.

However, while it remains popular due to its affordability and quick jump on fads, the retail giant has come under increasing fire in recent years for its copyright usage, labour practices, and competitive behaviour.

It has also received substantial criticism for its poor environmental standards, generating around 6.3 million tons of carbon dioxide annually, and made headlines last month for inviting influencers on a trip to its warehouses, which raised questions about disguised consumer manipulation.

At present, it’s being sued by plaintiffs for these reasons, the most damning of them all being its repeated infringements that are so aggressive, they’re said to amount to racketeering.

The filing, which reads that ‘it is not an exaggeration to suggest that SHEIN’s pattern of misconduct involves commission of new copyright and trademark infringements every day,’ claims that SHEIN is in violation of the Racketeer Influenced and Corrupt Organisations Act (RICO).

According to the lawsuit, in an organised effort to create as many as 6,000 new items per day, SHEIN uses a ‘byzantine shell game of a corporate structure’ to rip off designers, a coordinated illegal operation that can best be combatted ‘through the use of RICO statutes.’